Our Process

Simplify Your Finances with Our Family-Owned Practice

Feel Organized and Confident at Every Milestone

Over the years, we’ve enjoyed helping our clients organize their finances in an effort to simplify their lives; we want to give them the confidence to say, “Yes!” to more of what they love to do. Although each new milestone you face can feel like uncharted territory, as a multi-generational, family-owned practice, we’ve already been where you’re planning on going or where you want to go. We’ve helped guide families through every life stage, but we understand that your circumstances are unique. That’s why we provide personalized, objective advice to keep you organized and focused on the things and people you love.

“We Care About You and Your Assets More Than Anyone That Doesn’t Share Your Last Name.”

A Commitment to Clarity and Care

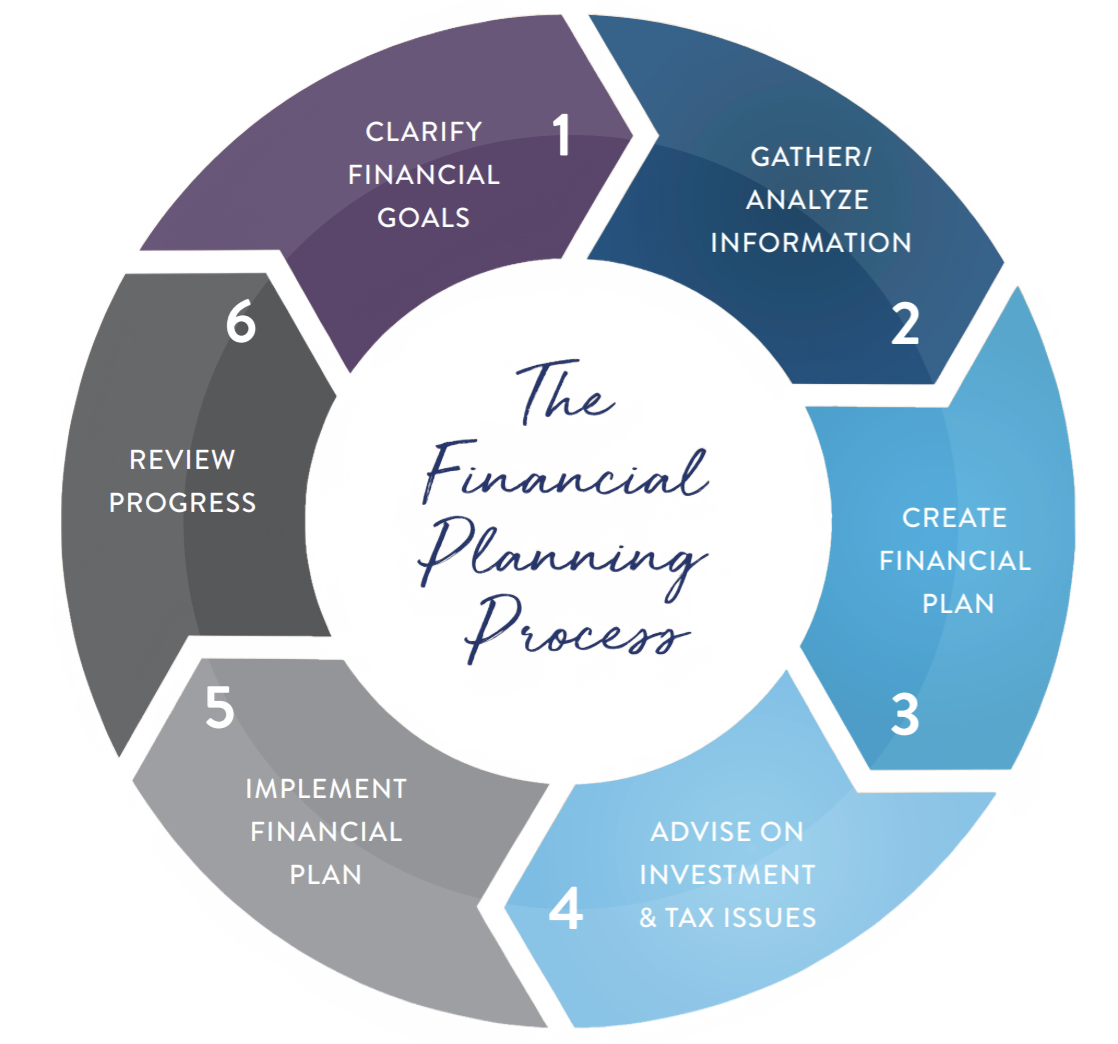

Your Financial Journey

Discovery Meeting

Understand your goals, values, and current situation.

Meeting 1

Meeting 2

Goals/Asset Review

Define your financial objectives and review your current assets.

Meeting 3

Financial Plan Review

Explore a custom financial strategy designed to fit your life.

Meeting 4

Integration

Review

Monitor the progress and ensure everything is being implemented as planned.

Ongoing

Annual Navigator

Annual check-ins and strategic updates to keep you on track.

*Tax services offered through Montage Wealth Advisors. Cetera Wealth Services, LLC does not provide tax or legal advice.

Annual Navigator

Period 1

- Prepare The Tax Return For The Current Year

- Tax Plan For The Year Ahead

- Review Paystub

- Review Savings Strategies

- Roth Conversion Analysis

- Review Distribution Strategies

- Review Gifting Strategies

- Review Service Agreement

- Review Investment Policy Statement

- Review Drift Tolerance And Rebalance Accounts

- Review Asset Allocation And Make Any Necessary Changes

Period 2

- Benchmark financial plan

- Estate planning analysis

- Elder care planning

- Review document storage and communications

- Review beneficiaries

- Review emergency preparedness

- Review life insurance

- Review homeowners insurance

- Review auto insurance

- Review liability insurance

- Review long-term care insurance

- Review disability insurance

- Review health insurance

- Update plan with new Social Security amounts

- Check account drift tolerance and rebalance as necessary

- Review asset allocation and change as necessary

Period 3

- Tax loss harvesting analysis

- Review identity theft risk

- Review property taxes

- Review mortgage

- Review credit card debt and points

- Review home equity line of credit

- Review security-backed line of credit

- Review auto loan

- Review account balances and compare to plan

- Check account drift tolerance and rebalance as necessary

- Review asset allocation and change as necessary

- Finalize Roth conversion analysis

- Review benefit options during open enrollment

Our Technology

Experience the Power of AdviceWorks

As part of your personalized financial journey, you will gain access to AdviceWorks – an intuitive, all-in-one platform designed to simplify and elevate your financial planning experience.

View Your Complete Financial Picture

See how AdviceWorks gives you a holistic view of your accounts, goals, and progress.

Creating Your Financial Roadmap

Build your long-term plan with clarity, confidence, and powerful tools based on your goals.